AI can make your selfies look flawless; be your virtual assistant, digital therapist or algorithm-fueled fitness trainer; spread misinformation; perk up your resumé and perfect your cover letter; write your emails, write your wedding speeches, write your novel—and perhaps steal and plagiarize that novel; be very fun; be very wrong; create playlists, grocery lists, and deepfakes; and, perhaps most of all, AI can cause you to question how much you should be using AI.

How much you should be using AI becomes even more paramount when it comes to something else AI can do: manage your money. According to a Bloomberg report, the AI fintech industry is expected to grow to $1.3 trillion dollars over the next decade.

But already there are robo-advisors that can text you trading tips, chatbots that can help with financial planning, even AI apps that can handle awkward money conversations, like negotiating rent with your landlord. All being used to help grow your money in a more straightforward and easy way.

At the same time, you can lose money, too, because as with all things AI-related: It's complicated. Sure, the idea of having a financial planner in your pocket sounds nice. It's just that the technology is new, which means it's not always accurate; so-called "experts" are still figuring it out. And as we learned with chatbot therapists, it's hard for machines to understand people's irrational, nuanced, and contradictory selves. The same goes for our financial wellbeing.

Which is why we talked to a few humans—and tried out a few robo-advisors—to find out whether all of these futuristic tools can actually prepare you for, well, a solid financial future.

Banker Bots Worth Considering

Cleo

Billed as an "AI assistant dedicated to personal finance," this app will help you "sort your shit out." That means calling you out if you spend too much on takeout or splurge on another vintage bag—and hyping you up when you meet your money goals. It also has a tool that will help you negotiate away rent increases, credit card fees, and help you get better deals on recurring expenses, like car payments.

Stay In The Know

Marie Claire email subscribers get intel on fashion and beauty trends, hot-off-the-press celebrity news, and more. Sign up here.

Wally

The personal finance app helps you track your spending, savings, and overall financial wellness. It includes WallyGPT, which you can ask hyper-specific questions, like: Am I saving enough of my monthly income? How have my expenses changed over the past four months? How much do I need to save each month for a week-long trip to Greece? It can also explain financial terms and trends and give recommended investment advice.

SoFi's Robo-Advisor

The app promises to "help you do less guessing and more investing." You can get started with just $1 and its automated investing tool will put together a plan according to your risk tolerance, time horizon, and financial goals. It will automatically give everything an adjustment every quarter, too.

Magnifi

Designed to look like a text thread, this app allows you to chat with an AI-investing assistant about everything from what to do with your bonus to how to find sustainable investments.

Acorns

An app that uses AI-driven algorithms to round up your purchase to the nearest dollar, and then, through its robo-advisor platform, invests that money for you.

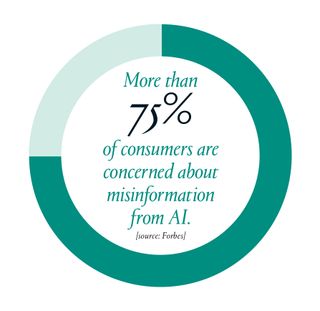

infographic of money and AI

A Few Things to Know Before You Download the Apps

You shouldn't get too personal

Read and understand how your information will be used and if it will be shared outside of the service you're signing up for.

The AI overlords won't judge your finance questions

The shame, anxiety, and stress around money can be paralyzing. It can be hard to tell a dude in a stuffy suit that you're in your 30s but don't have a savings account yet or that you don't know what a Roth IRA actually is. AI services come sans stigma, which can make it easier to seek out advice.

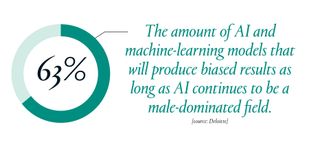

But it can also be sexist and racist

The technology that powers artificial intelligence is prone to machine-learning bias, which means it has a tendency to mirror human prejudices that exist in society. When it comes to money, that shows up in several ways: Algorithms that determine who should get loans have been shown to discriminate against people of color. Those very same algorithms are responsible for telling those very same people how to invest their money. There have also been cases where men and women with the same credit scores, incomes and expenses, are approved for varying credit limits—the men always receiving more (in one case, 20 times higher).

Robots aren't sad about losing your money

AI is not a fiduciary. That means it's not obligated to act in your best interest.

Wait, what exactly is a robo-advisor?

Technically, it's not a robot at all. It's technology that provides automated financial information and guidance. If you've ever chatted with customer service "bots" online, it's a similar experience. But with robo-advisors, the conversations often appear on your phone like you're texting with a financially savvy friend.

Different services offer different things. But, generally, you answer a few questions about your money goals, income, age, and financial situation. From there, you can ask your robo-advisor anything, from the general (What's an ETF?) to the specific (How can I pay off my credit card debt in three years while not giving up my love of travel?). What would perhaps take you hours—days!—to calculate, takes the algorithm mere seconds.

When it comes to investing, AI scrapes through existing data to help find investments that make sense for you and your specific scenario. No appointment required.

It's Cool to Use AI For...

- Generating personalized negotiation letters to help you lower monthly expenses, like rent, car insurance, or credit card fees

- Assessing your spending patterns—whether you're planning for a wedding or aiming to spend less on eating out—and providing insights to improve your budget planning

- Detecting fraud for credit card transactions by analyzing typical spending patterns and spotting unusual transactions

But Maybe Not For...

- Answering super-personal finance-related questions that can’t be based off pre-existing data

- Any financial decisions that involve more than $1,000 (find yourself a good old-fashioned human for that, as it’s good to have a gut check)

- Helping with any emotion-based budget planning money decisions, like experiences you should or shouldn’t spend your money on

Will Robots Replace Human Financial Planners?

"We're not convinced it can replace the responsiveness, empathy, and complex thinking that humans are capable of. While a good deal of AI tech does exist to make our lives easier, we don't think it can take the place of a living, breathing, ever-evolving humans when it comes to financial planning." —Sallie Krawcheck, Ellevest founder and CEO

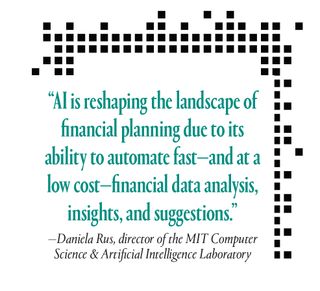

"The answers provided by AI are not always 100 percent correct, and a human financial advisor is needed to interpret the results and provide actionable suggestions. You can think of an AI financial planning system as the assistant that empowers the human advisor to do more. AI lacks the human touch, emotional intelligence, and ethical considerations for financial planning. AI and human advisors will more likely work in tandem, with AI handling data-driven tasks while humans tackle the more subjective, complex aspects of financial planning." —Professor Daniela Rus

"I think it's possible that some of the more routine work that financial planners do could be replaced with AI. If you could talk to a bot that elicits from you what your priorities and preferences are—and has your financial information and retirement or other plans—it could potentially help you plan ahead." —Professor Cynthia Rudin

"No, we don't believe human advice will ever go away. The machines do a great job synthesizing and organizing insights and knowledge, but it takes humans to create those ideas in the first place. Machines regurgitate what they are taught, and it takes humans to teach them, so with that in mind we can't see a world where machines take the place of human insight." —Koren Picariello

Alexis Benveniste is a New York-based writer and editor who covers business, travel, culture, beauty and commerce. She has written for The New York Times, Vanity Fair, Bloomberg, and other outlets.

-

Katie Holmes Cracks the Commuter Outfit Code

Katie Holmes Cracks the Commuter Outfit CodeHer relatable wardrobe staples strike again.

By Lauren Tappan Published

-

Gwyneth Paltrow Loves This Reality Show and She's Never Been More Relatable

Gwyneth Paltrow Loves This Reality Show and She's Never Been More RelatableShe's a fan of having a "slovenly day," too.

By Meghan De Maria Published

-

Jennifer Lopez Goes From Pilates Princess to Rich Mom in One Day

Jennifer Lopez Goes From Pilates Princess to Rich Mom in One DayShe's still all-in on the loud luxury lifestyle.

By India Roby Published